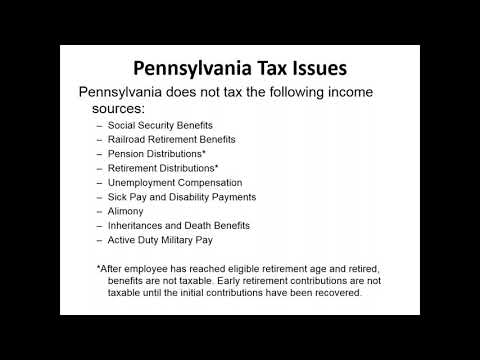

Well, welcome back everyone. Nice little morning discussion on insurance and how we reported on income tax returns. We're going to change gears here a little bit and talk about state tax issues. Just wanted to kind of start off with a filing requirement reminder of what we're looking at for the Commonwealth of Pennsylvania. Even though we had already addressed this in the income section, I want to remind you what Lancaster County would look like as well. The main reason is that the local return system mirrors much more of the state system than it does the federal. Both of these, you're not going to find in the Form 1040 or other IRS material, but they are found in your volunteer guide on how to prepare our state/local returns. One issue we have with Pennsylvania is that Pennsylvania is going to require a return to be filed in 2018 if you have $33 of income. So, no $12,000 standard deduction. $24,000 or add a couple thousand on there if you're over 65. $33 is the threshold. The reason why is Pennsylvania has a nice tax rate to calculate, 3.07 percent flat tax irrespective of the amount of income that you have. Now, they must have gone to the IRS school to figure out that let's just use numbers that are a little off, 8.05 percent, 3.07 percent, let's just try and get somewhere close there. But we're looking at 3.07 percent flat tax. There is a requirement that anyone with over $33 in income would need to file a return. Minors are not excluded. So technically, if an individual at the age of eight has interest income and dividend income because their grandparent thought it would be kind of nice to give them a couple shares of Disney stock...

Award-winning PDF software

Pa corporate tax return instructions 2025 Form: What You Should Know

See the following page for the instructions for the 2025 corporation tax return, the 2025 corporate tax Return, the 2025 corporate tax Return and the 2025 corporate tax report. City of Philadelphia Corporate Tax Return Instructions City of Philadelphia Corporate Net Income Tax Corvée & Associates LLP 200 Market Street Suite 1 Philadelphia PA 19103 Phone: Tax Forms — Commonwealth of Pennsylvania A Guide to Income Tax Returns for the Commonwealth of Pennsylvania Corporation tax forms for 2005, 2006, and 2007. Corporate Federal-State income tax rates for 2025 (page 12). 2025 Corporation Income tax return instructions. 2025 Corporate Tax Return instructions. 2025 Corporation Income tax return instructions. 2025 Corporate Net Income Tax return instructions. 2025 Corporation Income tax return instructions. 2025 Corporate Net Income Tax return instructions. 2025 Corporation Income tax return instructions. 2025 Corporate Net Income Tax return directions. 2025 Corporation Income tax Return instructions. 2025 Corporation Net Income Tax return instructions. Commonwealth of Pennsylvania and Philadelphia A Guide to Income Tax Returns for the Commonwealth of Pennsylvania, Philadelphia City of Philadelphia Corporate Information See the following pages for the Corporate returns, instructions, worksheets, and forms for the Pennsylvania corporation Taxes: Corporate Tax Returns, corporation tax information, corporate tax rates, and information on Corporations in the Commonwealth of Pennsylvania. Corporation Returns: Tax returns for corporations are due December 31st of the year in which the return is filed and are filed according to the forms provided by the Pennsylvania Department of Revenue.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 12508, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 12508 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 12508 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 12508 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Pa corporate tax return instructions 2025