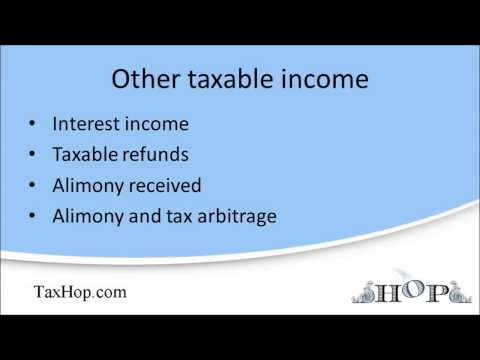

Interest income follows wage income on your 1040. - If you received more than ten dollars in interest from a bank or other financial institution, you should receive a 1099-INT. - This should include payments from individual bonds that you hold, but not tax-free bonds. - If you receive tax-free interest, you won't receive a 1099, but the IRS still wants to know how much tax-free interest you received. - However, make sure you don't include tax-free interest in your taxable income. - If you received more than four hundred dollars in taxable interest or dividends, you'll have to fill out Schedule B. - If you have a money market mutual fund or bond mutual fund, notice that payments you receive from these funds aren't called interest payments. - Money market mutual fund payments may look like interest payments, but distributions from funds are called dividends or capital gains distributions, or possibly a return of capital. - Don't count any of these as interest payments either. - These payments will be disclosed to you on a 1099-DIV statement from your mutual fund. - Notice you'll only receive these statements for your taxable mutual funds. - If you hold tax-sheltered mutual funds like money in an IRA or 401k account, you shouldn't receive a 1099 until you actually withdraw money from the account, usually after you retire. - After you fill in your taxable interest, you'll have to enter your taxable refunds. - This line mostly concerns those who itemize their deductions. - If, for example, you itemize your deductions and you received a refund for last year's state income taxes, you may have to report the refund as taxable income. - If you didn't itemize last year, you shouldn't have to worry about this income item. - If you received...

Award-winning PDF software

Reporting ex spouse to irs Form: What You Should Know

For these purposes, a dependent is a person who for tax purposes, would be your spouse or former spouse regardless of whether he or she files a separate return. How to request Innocent Spouse Relief — IRS A request for innocent spouse relief may be filed by the spouse filing the return, by request to change the order of personal exemption or the other provisions of the tax law, or by declaration of nullity. If a dependent file one of these, the dependent needs to complete the form and send it to Form 8857, which provides the basis of relief. This can be done by the form 1040-C or by the IRS Form 2210. Filing Information Returns and the Innocent Spouse Relief Program, IRS Under section 4709 of the Internal Revenue Code, relief is granted based on the theory that any child under age 19 whose relationship to the filing taxpayer is determined to be wholly or partially that of a child for purposes of section 3(b)(2)(A) or (B) of the Social Security Act is an innocent spouse or the unmarried minor child of such a nonresident spouse in the case of an alien individual or the unmarried minor child of such an alien individual. For this purpose, an individual who is not a U.S. citizen or resident, and is not eligible for withholding, is treated as a U.S. citizen, resident, under a withholding treaty of a foreign country, or eligible for any exemption or credit with respect to U.S. taxes. The court may grant a motion for innocent spouse relief on an order for specific performance. The requirements for a request for innocent spouse relief under section 4709 depend on if you and your nonresident spouse are not married to each other, or you are divorced or legally separated by order of a final order filed within the last 90 days. There is no requirement for you to reside in the same physical place as your nonresident spouse.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 12508, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 12508 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 12508 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 12508 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Reporting ex spouse to irs